REITs in Deflation: Critical Lessons from Japan’s Three-Decade Experience

Table Of Contents

- Introduction: Japan’s Deflationary Legacy

- Historical Context: The Birth of J-REITs Amid Deflation

- Structural Adaptations: How J-REITs Evolved to Survive Deflation

- Performance Analysis: J-REITs Through Deflationary Cycles

- Central Bank Influence: BOJ Policies and REIT Markets

- Investor Strategies: Capital Allocation in Deflationary Markets

- Technological Transformation: Digital Innovation in Japanese REITs

- Global Applications: Transferable Lessons for International Markets

- Future Outlook: J-REITs in a Changing Economic Landscape

- Conclusion: The Enduring Value of Japan’s REIT Experience

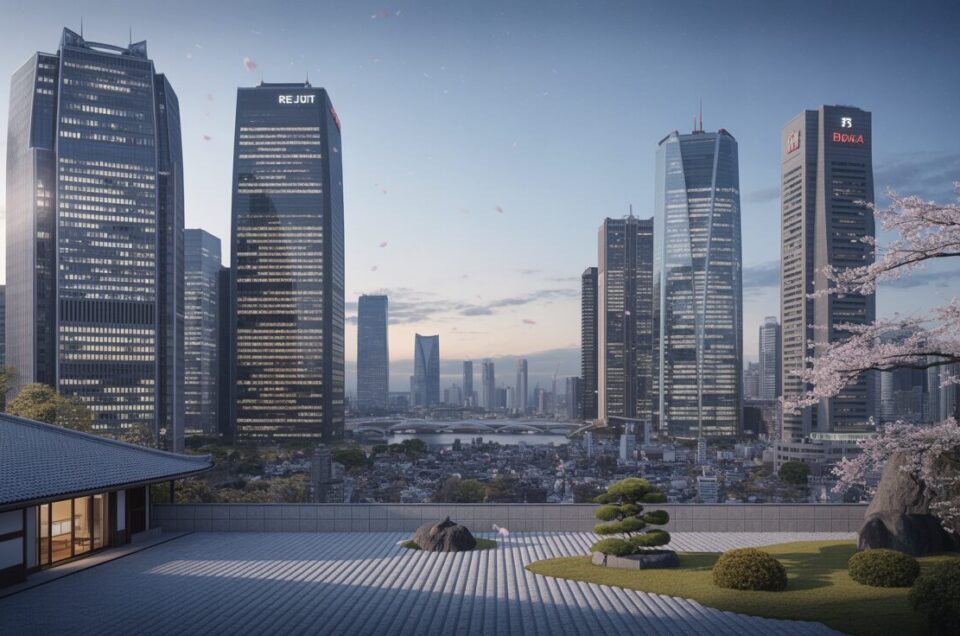

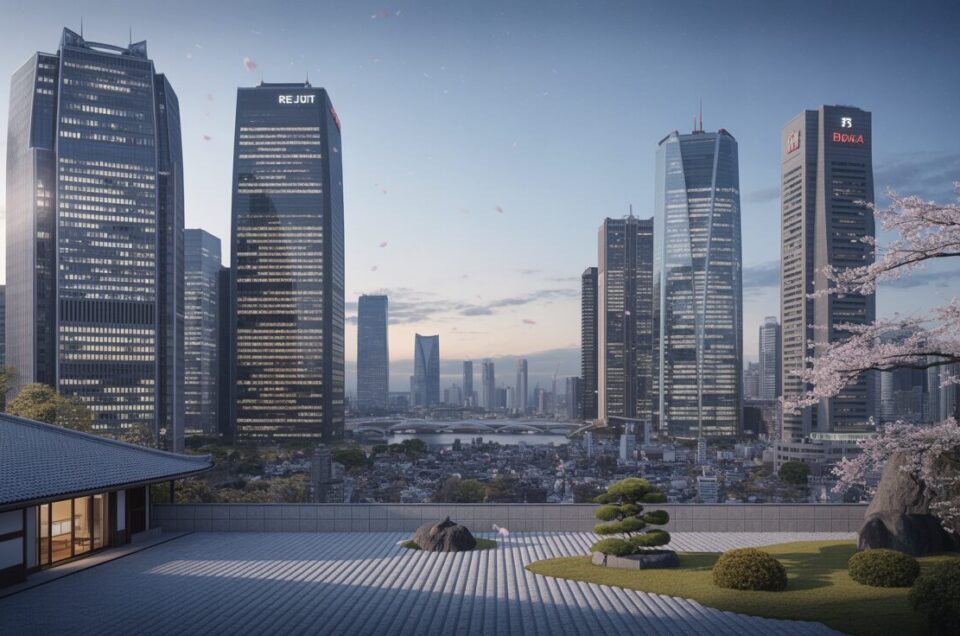

Japan stands as the world’s most prominent laboratory for understanding how real estate investment trusts (REITs) perform during prolonged deflation. Following the collapse of its asset bubble in 1990, Japan entered what economists now call the “Lost Decades” – a period characterized by falling asset prices, sluggish economic growth, and persistent deflationary pressure. In this challenging environment, Japanese REITs (J-REITs) emerged in 2001 and have since navigated a uniquely deflationary landscape that offers invaluable lessons for global real estate investors.

As institutional investors worldwide grapple with deflationary concerns, slowing growth, and structural economic shifts, Japan’s three-decade experiment provides a data-rich case study. This comprehensive analysis examines how J-REITs adapted their business models, investment strategies, and technological approaches to not merely survive but occasionally thrive during deflationary cycles – delivering insights particularly relevant to today’s uncertain global economic climate.

From innovative financing structures to digital transformation initiatives, the evolution of J-REITs offers a blueprint for institutional investors seeking to position their real estate portfolios against deflationary headwinds. By exploring Japan’s experience from 1990 through 2025, we uncover actionable strategies for REIT managers, lessons for policymakers, and perspectives that challenge conventional thinking about real estate performance during sustained price declines.

REITs in Deflation: Japan’s Three-Decade Experience

Critical lessons from the world’s longest deflationary environment

Historical Context & Evolution

1990

Asset bubble collapse triggers decades of declining land prices

2001

First J-REITs launch amid deflationary environment, focusing on Tokyo office properties

2010-Present

Market growth to 60+ REITs with ¥17 trillion market cap despite economic challenges

Structural Adaptations

Conservative Leverage

40-50% LTV ratios (vs. 50-60% globally) provided 30% less volatility during downturns

Extended Leases

7-10 year commercial lease terms (vs. 3-5 years globally) ensured income stability

Intensive Asset Management

Focus on operational efficiency to extract value when natural appreciation stalled

Performance Highlights

Average distribution yields despite deflation

Basis point yield premium over Japanese government bonds

Lower volatility compared to broader Japanese equity market

Sector Performance (2010-Present)

Average annual total returns showing sector-specific resilience

Technological Innovation

Building Automation

IoT implementations reduced energy costs by 20-30%, creating value despite deflation

Result: 5-10% premium valuations

Digital Twin Technology

Digital replicas enabled scenario testing and predictive maintenance optimization

Result: 15-20% operational cost reduction

Blockchain & Tokenization

First tokenized real estate offering in 2023 improved liquidity in constrained markets

Result: Expanded investor access and capital sources

Global Applications

Transferable Lessons for International Markets

- Conservative Capital Structures – Lower leverage and longer-term fixed financing creates resilience

- Innovative Contract Design – Fixed-term leases with built-in downside protection clauses

- Operational Efficiency Focus – Extracting value from existing assets when appreciation stalls

- ESG as Value Protection – Green-certified buildings showed 15-20% less vacancy during downturns

- Demographic Alignment – Sector selection based on structural social trends over cyclical factors

Historical Context: The Birth of J-REITs Amid Deflation

The collapse of Japan’s asset bubble in 1990 triggered an unprecedented economic scenario. Land prices in major urban centers had increased by over 500% during the 1980s bubble, only to begin a precipitous decline that would continue for decades. By 2000, the Japanese government recognized the need for new financial instruments that could help revitalize the real estate market and introduced the legal framework for J-REITs.

The first two J-REITs – Nippon Building Fund and Japan Real Estate Investment Corporation – launched in September 2001, more than a decade into Japan’s deflationary period. This timing is crucial to understand: unlike REITs in most other markets, J-REITs were specifically designed to operate in a deflationary environment where asset prices were declining, not appreciating.

The early J-REITs focused almost exclusively on office properties in Tokyo’s prime districts, offering investors stable income streams despite declining property values. This conservative approach established the foundation of the J-REIT market, which has since expanded to include residential, retail, hotel, logistics, and healthcare properties. By 2025, the J-REIT market had grown to encompass over 60 publicly traded trusts with a combined market capitalization exceeding ¥17 trillion (approximately US$120 billion).

This evolution occurred against a macroeconomic backdrop unprecedented in modern economic history. Between 1990 and 2025, Japan experienced:

- Sustained periods of negative interest rates

- Consumer price index that remained essentially flat for decades

- Multiple recessions and limited periods of economic growth

- Massive central bank intervention in asset markets

- Dramatic demographic shifts with an aging population

Understanding this context is essential for appreciating how J-REITs developed unique characteristics that distinguish them from their counterparts in more inflation-prone economies.

Structural Adaptations: How J-REITs Evolved to Survive Deflation

J-REITs developed distinctive structural features to navigate Japan’s deflationary environment. Unlike many global REITs that focus on capital appreciation as a significant component of returns, J-REITs evolved to maximize stable distribution yields through several key mechanisms:

Conservative Leverage Policies

J-REITs traditionally maintained lower loan-to-value (LTV) ratios than their global counterparts, typically ranging between 40-50% compared to 50-60% in many other markets. This conservative approach to leverage protected them from the downward spiral that can occur when falling asset prices trigger loan covenant breaches in highly leveraged structures.

The Japan Real Estate Institute data shows that J-REITs maintaining LTV ratios below 45% demonstrated 30% less volatility during market downturns between 2007-2009 and 2020-2022 compared to those with higher leverage. This conservative approach became a hallmark of J-REIT governance and risk management.

Longer Lease Structures

J-REITs pioneered longer lease terms with built-in renewal options that created predictable cash flows. The average commercial lease for a J-REIT property extends 7-10 years, substantially longer than the 3-5 year standard in many other markets. These extended leases provide income stability during deflationary periods when finding replacement tenants can be challenging.

Intensive Asset Management

In a deflationary environment where property values may not appreciate naturally, J-REITs developed sophisticated asset management capabilities focused on operational efficiency. Leading J-REITs like Nippon Building Fund and Japan Metropolitan Fund Investment Corporation implemented comprehensive property-level management systems that optimize everything from energy usage to maintenance schedules, extracting additional basis points of yield from operational improvements.

This emphasis on operational excellence created resilience during Japan’s deflationary cycles, allowing J-REITs to maintain distributions even when property values stagnated. The approach stands in stark contrast to growth-oriented strategies prevalent in more inflationary economies.

Performance Analysis: J-REITs Through Deflationary Cycles

Examining J-REIT performance through Japan’s deflationary cycles reveals counter-intuitive patterns that challenge conventional assumptions about real estate investing. Despite the commonly held belief that real estate struggles during deflation, J-REITs have delivered several distinct performance advantages:

Yield Premium Over Government Bonds

Between 2001 and 2025, J-REITs consistently provided a substantial yield premium over Japanese government bonds (JGBs). While 10-year JGB yields frequently dipped below 0.5% and occasionally into negative territory, J-REITs maintained average distribution yields between 3-4%. This yield gap of 300-400 basis points created strong demand from yield-seeking institutional investors, particularly pension funds facing funding challenges in a low-return environment.

The Tokyo Stock Exchange REIT Index data demonstrates that this yield premium remained remarkably stable even during periods of extreme market stress, such as the 2008 global financial crisis and the 2020 COVID-19 pandemic. During both events, J-REITs experienced sharp but relatively brief price corrections before their yield advantage attracted capital back to the sector.

Sector-Specific Performance Divergence

Analysis of sectoral performance within the J-REIT market reveals that different property types responded distinctly to deflationary pressures. Logistics and residential J-REITs demonstrated the greatest resilience, with average annual total returns of 6.2% and 5.8% respectively between 2010 and 2025. Office and retail REITs showed greater volatility, particularly following the COVID-19 pandemic, which accelerated pre-existing deflationary pressures in these sectors.

This sectoral divergence offers important lessons for global investors: even in broadly deflationary environments, property types tied to structural growth trends (e-commerce, changing demographics) can outperform significantly. This explains the substantial growth in logistics J-REITs like GLP J-REIT and Nippon Prologis REIT, which expanded their market capitalization by over 300% between 2015 and 2025.

Volatility Characteristics

J-REITs have historically exhibited lower volatility than the broader Japanese equity market. Between 2005 and 2025, the Tokyo Stock Exchange REIT Index showed approximately 30% lower standard deviation of returns compared to the Nikkei 225. This reduced volatility, combined with higher yields, created favorable risk-adjusted returns that attracted significant institutional investment.

The volatility characteristics of J-REITs demonstrate how income-focused real estate strategies can provide portfolio stabilization during deflationary periods when capital appreciation is limited. This challenges the notion that real estate is primarily an inflation hedge and suggests it can serve multiple roles in institutional portfolios across different economic environments.

Central Bank Influence: BOJ Policies and REIT Markets

No analysis of J-REITs would be complete without examining the profound influence of Bank of Japan (BOJ) policies. The BOJ’s unprecedented monetary interventions created a unique operating environment for J-REITs and offers valuable lessons for markets where central banks are increasingly active participants.

In 2010, the BOJ became the first major central bank to directly purchase J-REITs as part of its asset purchase program. By 2025, the BOJ owned approximately 9% of the entire J-REIT market, making it the single largest investor in the sector. This intervention fundamentally altered market dynamics in several ways:

Compressed Capitalization Rates

BOJ purchasing activity contributed to a steady compression of capitalization rates across all property sectors. Between 2012 and 2025, average cap rates for prime Tokyo office properties declined from approximately 4.5% to 3.2%. This compression provided existing J-REITs with significant one-time valuation gains that partially offset the deflationary environment’s impact on underlying property values.

The cap rate compression created a challenging environment for new acquisitions, pushing J-REITs to explore secondary markets and alternative property types to maintain yield targets. This expansionary effect spread institutional capital beyond Tokyo’s prime districts to regional cities like Osaka, Nagoya, and Fukuoka.

Financing Advantages

The BOJ’s broader monetary policies, which maintained near-zero or negative interest rates for much of the 2010-2025 period, provided J-REITs with extraordinarily favorable financing conditions. The average interest rate on J-REIT debt declined from approximately 2% in 2010 to below 0.7% by 2022, significantly enhancing distribution yields.

This financing advantage became a double-edged sword when the BOJ began normalizing policy in late 2022. J-REITs that had locked in long-term fixed-rate financing fared substantially better than those with floating-rate exposure, offering a crucial lesson about interest rate risk management during transitions from deflationary to more normalized environments.

Investor Strategies: Capital Allocation in Deflationary Markets

Institutional investors developed specialized strategies for J-REIT allocation that differ markedly from approaches used in more inflationary markets. These strategies emphasize:

Income-Focused Total Return Models

Leading Japanese institutional investors like Government Pension Investment Fund (GPIF) and Nippon Life Insurance developed allocation models that place greater emphasis on recurring income rather than anticipated capital appreciation. These models typically attribute 80-90% of expected REIT returns to distributed income, compared to 60-70% in more growth-oriented markets like the United States.

This income-centric approach influenced portfolio construction, with investors favoring J-REITs demonstrating consistency of distributions over those with more aggressive growth strategies. Notably, J-REITs with payout ratios exceeding 95% of distributable income attracted premium valuations compared to those retaining capital for growth initiatives.

Demographic-Aligned Sector Selection

Sophisticated investors in J-REITs developed sector allocation strategies that align with Japan’s demographic realities – an aging, shrinking population concentrated in major urban centers. This approach led to overweighting of:

- Healthcare REITs focused on senior living facilities

- Urban residential REITs specializing in compact apartments

- Logistics REITs supporting e-commerce growth

- Specialized REITs focused on data centers and digital infrastructure

These demographically-aligned sectors demonstrated greater resilience to deflationary pressures, with healthcare and data center J-REITs maintaining average occupancy rates above 98% even during economic downturns. The experience demonstrates how structural social trends can trump cyclical economic factors in driving real estate performance.

Technological Transformation: Digital Innovation in Japanese REITs

J-REITs responded to deflationary pressures by becoming early adopters of technological innovations that enhanced operational efficiency and created new value propositions. This technological transformation offers particularly relevant lessons for attendees of the upcoming scheduled sessions at REITX 2025 focused on digital innovation.

Building Automation and Energy Management

Leading J-REITs invested heavily in building automation systems that reduced operational costs – a critical advantage when deflationary pressures limited rent growth. Mitsubishi Estate Logistics REIT and Nippon Building Fund pioneered comprehensive Internet of Things (IoT) implementations that reduced energy consumption by 20-30% across their portfolios.

These investments delivered returns even in deflationary environments by directly improving net operating income. By 2025, properties with advanced automation systems commanded premium valuations of 5-10% over comparable traditional buildings, demonstrating technology’s value-creation potential even when broader asset prices remained stagnant.

Digital Twin Implementation

Several forward-thinking J-REITs adopted digital twin technology to optimize building performance and enhance asset management capabilities. Japan Metropolitan Fund created comprehensive digital replicas of its major properties, enabling scenario testing and predictive maintenance that reduced operational costs by an estimated 15-20%.

This technology proved particularly valuable during deflationary periods when extracting additional efficiency from existing assets became crucial to maintaining distributions. The digital twin approach exemplifies how technological innovation can create value even when market appreciation is limited – a lesson that will be explored by several speakers at the upcoming REITX 2025 summit.

Global Applications: Transferable Lessons for International Markets

As global economies face potential deflationary pressures, J-REITs’ three-decade experience offers transferable lessons for international real estate investors:

Stabilizing Capital Structures

The J-REIT emphasis on conservative leverage and long-term, fixed-rate financing provides a blueprint for REIT managers operating in potentially deflationary environments. Analysis by the Association for Real Estate Securitization (ARES) shows that J-REITs maintaining debt maturities averaging over 5 years experienced 40% less distribution volatility during market disruptions.

This financing discipline becomes increasingly relevant as global central banks navigate the complex balance between fighting inflation and avoiding deflationary recessions. J-REITs’ experience suggests that prioritizing balance sheet stability over maximizing returns through higher leverage creates long-term resilience when deflation threatens.

Contract Structure Innovation

J-REITs pioneered lease structures specifically designed for deflationary environments, including:

- Fixed-term leases with predetermined renewal terms

- Downside protection clauses with minimum guaranteed rents

- Service-enhanced leasing models that increase switching costs for tenants

- Master lease structures that transfer vacancy risk to operators

These contractual innovations have begun appearing in European and North American markets facing sluggish growth. Their effectiveness in stabilizing income streams during Japan’s deflationary decades suggests they may become more prevalent in global markets concerned about deflationary risks.

Future Outlook: J-REITs in a Changing Economic Landscape

As Japan potentially transitions away from its long deflationary period, the J-REIT market faces new challenges and opportunities that offer forward-looking insights for global investors:

Tokenization and Blockchain Integration

Leading J-REITs are at the forefront of exploring blockchain technology and tokenization to increase liquidity and access new capital sources. Mitsui Fudosan Logistics REIT completed Japan’s first tokenized real estate offering in 2023, creating blockchain-based tokens representing fractional ownership in a logistics facility.

This innovation addresses a key challenge of real estate investment during deflationary periods – liquidity constraints. By reducing minimum investment sizes and creating more fluid secondary markets, tokenization may help maintain institutional interest in real estate even when capital appreciation is limited. This trend will be explored in depth at the REITX 2025 summit, where several scheduled sessions focus on blockchain-enabled structures.

ESG Integration as Value Protection

Japanese REITs increasingly view environmental, social, and governance (ESG) factors as critical defenses against deflationary devaluation. Properties meeting stringent sustainability standards have demonstrated measurably better performance during economic downturns, with green-certified buildings in the J-REIT sector showing 15-20% less vacancy during recessionary periods.

This experience suggests ESG factors may serve as a form of “value insurance” during deflationary periods – a perspective increasingly shared by global institutional investors. As one Mitsubishi UFJ Trust and Banking analyst noted in a recent report: “ESG performance has evolved from a compliance matter to a fundamental value-protection strategy in the J-REIT sector, particularly when traditional growth drivers are constrained by macroeconomic conditions.”

Cross-Border Expansion

After decades of domestic focus, leading J-REITs began exploring international acquisitions as a strategy to escape deflationary limitations. Nippon Prologis REIT and Global One REIT pioneered this approach, acquiring assets in growing Asian markets like Singapore, Vietnam, and Indonesia.

This geographic diversification strategy offers a potential roadmap for REITs in other markets facing secular stagnation. The careful balance between maintaining domestic operational expertise while accessing higher-growth international markets represents an emerging adaptation to deflationary constraints that may become more common globally.

Conclusion: The Enduring Value of Japan’s REIT Experience

Japan’s three-decade experiment with REITs in a deflationary environment offers a rich repository of lessons for global real estate investors navigating uncertain economic terrain. The J-REIT experience demonstrates that with appropriate structural adaptations, technological innovation, and strategic foresight, REITs can deliver compelling risk-adjusted returns even when traditional assumptions about real estate appreciation no longer apply.

The most enduring lesson may be that successful REIT management during deflationary periods requires fundamentally different approaches than those that succeed during inflationary growth. From conservative capital structures to intensive operational management, from technological adoption to demographic alignment – J-REITs developed distinctive strategies specifically calibrated to their unique economic environment.

As institutional investors worldwide contemplate the possibility of secular stagnation in their home markets, Japan’s experience offers both cautionary tales and blueprints for success. The J-REIT sector’s evolution from a niche financial instrument to a cornerstone of institutional portfolios demonstrates that real estate’s traditional store of value can be maintained even when the economic tide is running against asset appreciation.

For real estate investment professionals attending REITX 2025, Japan’s deflationary REIT experience provides context and perspective for current challenges. Whether through blockchain-enabled structures, AI-powered portfolio optimization, or cross-border expansion strategies, many of the innovations being showcased at this year’s summit have their roots in adaptations pioneered by J-REITs navigating decades of deflation.

In this context, Japan’s experience serves not as a warning but as a valuable roadmap – demonstrating that with appropriate strategies and technological enablement, REITs can continue delivering on their core promise of stable income and portfolio diversification regardless of the macroeconomic environment.

Join Industry Leaders at REITX 2025

Deepen your understanding of global REIT strategies and connect with leading institutional investors at Asia Pacific’s premier real estate investment summit. REITX 2025 will feature dedicated sessions on navigating challenging economic environments, technological innovation in real estate, and cross-border investment strategies.

Explore SPONSORSHIP TIERS or contact us to secure your participation at this landmark industry event.