Case Study: How Solar Roof PPAs Are Revolutionizing Value Creation in Industrial REITs

Table Of Contents

- Introduction to Solar Roof PPAs in Industrial REITs

- Understanding Solar Power Purchase Agreements

- Case Study: Mapletree Industrial Trust’s Solar Roof Implementation

- Financial Benefits and Revenue Diversification

- ESG Advantages and Reporting Improvements

- Implementation Challenges and Solutions

- Future Outlook and Emerging Trends

- Conclusion

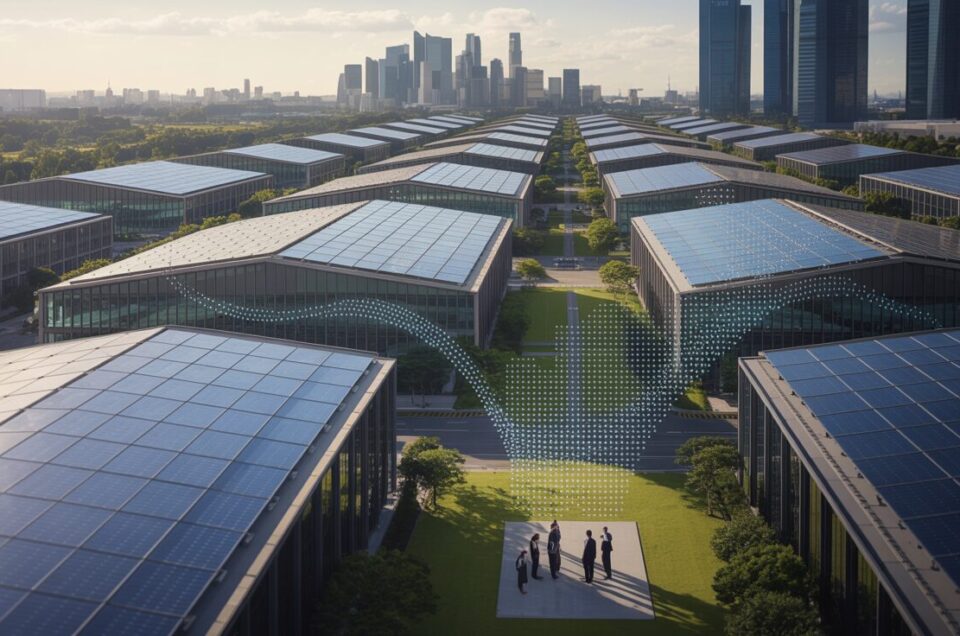

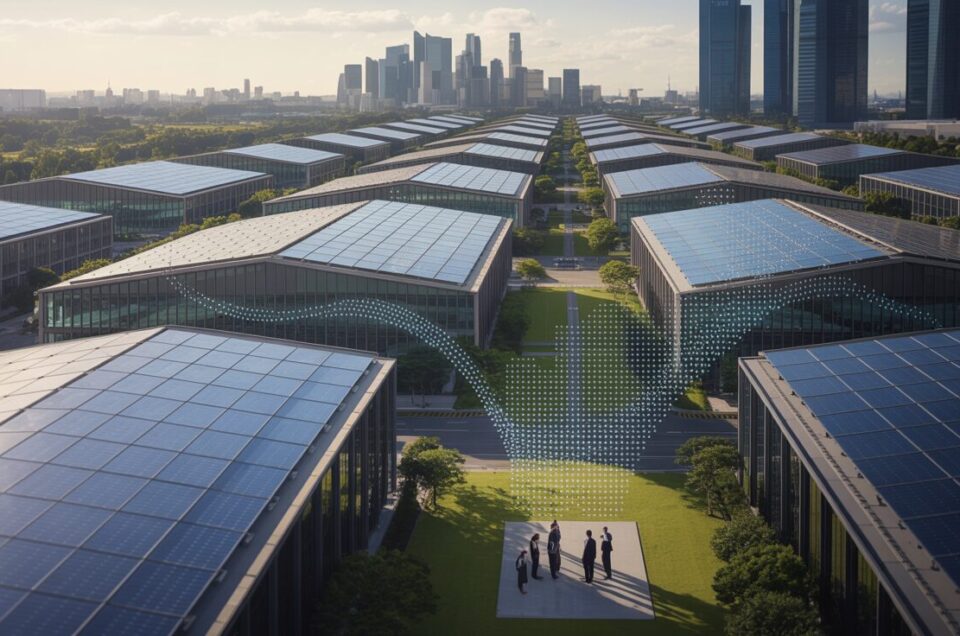

In the rapidly evolving landscape of commercial real estate investment, Industrial Real Estate Investment Trusts (REITs) are discovering untapped potential in an unexpected place—their rooftops. The vast, flat surfaces crowning warehouses, distribution centers, and manufacturing facilities represent not just structural components, but increasingly valuable real estate that can generate significant alternative revenue streams through Solar Power Purchase Agreements (PPAs).

As institutional investors increasingly prioritize sustainable investments with predictable returns, forward-thinking Industrial REITs across the Asia Pacific region are transforming underutilized roof space into solar power generating assets. This strategic pivot not only creates new revenue opportunities but also addresses growing ESG mandates, enhances property values, and provides tenants with clean energy options—all without significant capital expenditure from the REIT itself.

This case study examines how innovative Industrial REITs are implementing rooftop solar PPAs, analyzing the financial structures, returns on investment, implementation challenges, and the broader implications for the institutional real estate investment landscape. By exploring real-world examples from leading REITs in Singapore, Australia, and Japan, we’ll reveal how these arrangements are creating measurable value while positioning these trusts at the forefront of the renewable energy transition.

Understanding Solar Power Purchase Agreements

Solar Power Purchase Agreements represent a specific financial structure that enables Industrial REITs to monetize their rooftop space without direct capital investment in solar infrastructure. Under typical solar PPA arrangements, a third-party solar developer finances, builds, owns, and maintains the photovoltaic (PV) system installed on the REIT’s property rooftops. The REIT, in turn, receives revenue through one or more of several possible channels:

First, the REIT may collect roof rental fees from the solar developer, creating a steady income stream from previously non-revenue-generating space. Second, some arrangements include revenue sharing, where the REIT receives a percentage of electricity sales to the grid or to tenants. Third, REITs can benefit from reduced common area energy expenses when they consume a portion of the generated electricity at preferential rates.

What makes solar PPAs particularly attractive for Industrial REITs is the minimal capital outlay required. Unlike direct solar investments that demand significant upfront capital and ongoing maintenance expenses, PPAs allow REITs to maintain their focus on core real estate operations while still participating in renewable energy benefits. The contractual nature of these agreements—typically spanning 15-25 years—provides the predictable, long-term cash flows that institutional investors value highly.

For international investors attending the upcoming scheduled sessions at REITX 2025, understanding these financial structures is crucial, as they represent an emerging asset class within the industrial REIT sector that combines real estate fundamentals with renewable energy economics.

Case Study: Mapletree Industrial Trust’s Solar Roof Implementation

Mapletree Industrial Trust (MIT), a leading Singapore-listed Industrial REIT with a portfolio valued at over S$8.5 billion, represents one of the region’s most successful implementations of solar roof PPAs. Beginning in 2018, MIT partnered with Sunseap Group, a prominent solar developer, to install PV systems across multiple properties in its portfolio, starting with seven buildings and eventually expanding to 21 properties by 2023.

The arrangement structured by MIT demonstrates the sophisticated approach leading REITs are taking with solar PPAs. Rather than a simple roof rental arrangement, MIT negotiated a multi-faceted agreement that includes:

- Base roof rental payments from Sunseap that generate approximately S$900,000 annually

- Discounted electricity rates for common areas and participating tenants, reducing operating expenses by approximately 20% compared to grid prices

- Revenue-sharing mechanisms that provide MIT with a percentage of power sales to the grid during peak generation periods

The 49 MWp total capacity across MIT’s properties generates enough clean electricity to power approximately 12,500 four-room HDB flats annually. This represents a significant contribution to Singapore’s solar deployment targets while creating tangible financial returns for unitholders.

What makes MIT’s approach particularly instructive is how it integrated tenant participation into the model. By working with Sunseap to offer preferential electricity rates to tenants, MIT not only enhanced the value proposition for its occupants but also strengthened tenant relationships and improved retention rates. Data indicates that properties participating in the solar program have seen a 7% improvement in tenant renewal rates compared to non-participating properties.

Several industry experts who will be featured among the speakers at REITX 2025 were involved in pioneering this model, which has since been adapted by numerous industrial REITs across the region.

Financial Benefits and Revenue Diversification

The financial case for solar roof PPAs within industrial REITs has strengthened considerably as solar technology costs have declined while electricity prices have risen across much of the Asia Pacific region. Quantitative analysis of multiple industrial REIT solar implementations reveals several consistent financial advantages:

A properly structured solar roof PPA can increase Net Operating Income (NOI) by 2-4% across applicable properties. For industrial REITs with suitable roof configurations across 60-80% of their portfolio, this can translate to a meaningful 1.5-3% improvement in overall distribution per unit (DPU), a key performance metric for REIT investors.

Beyond the direct income enhancement, solar roof PPAs provide valuable revenue diversification. Unlike traditional rental income that fluctuates with market conditions, solar PPA revenues typically feature long-term fixed escalation rates and minimal correlation to real estate cycles. This creates a partial hedge against market downturns, improving overall portfolio resilience—a quality increasingly valued by institutional investors.

Another significant financial benefit comes through property valuation impacts. Properties with solar PPAs in place have demonstrated cap rate compression of 15-25 basis points compared to comparable non-solar properties. This valuation premium reflects the market’s recognition of both the additional income stream and the enhanced ESG profile these assets represent.

Australian-listed Goodman Group has been particularly successful in leveraging this valuation advantage, reporting that their solar-enabled properties command approximately 8% higher valuations than comparable non-solar assets in their portfolio, even accounting for the direct revenue contribution.

Common Revenue Models in Solar Roof PPAs

Industrial REITs have developed several revenue models for solar roof PPAs, each with distinct financial implications:

- Fixed Roof Rental Model: The simplest structure, where the REIT receives a predetermined lease payment for roof access, typically $0.10-0.25 per square foot annually, depending on location and roof quality. This model provides maximum predictability but potentially leaves value on the table.

- Revenue Share Model: The REIT receives a percentage (typically 5-15%) of the revenue generated from electricity sales. While this introduces some variability, it allows the REIT to participate in electricity price appreciation and improved solar generation efficiency.

- Hybrid Model: Increasingly common, this structure combines a lower guaranteed base payment with revenue participation, balancing predictability with upside potential.

- Tenant-Focused Model: The REIT negotiates discounted electricity rates for tenants as part of the PPA, potentially accepting lower direct payments in exchange for improved tenant satisfaction and retention.

ESG Advantages and Reporting Improvements

While financial returns remain the primary motivation for most solar roof PPA implementations, the ESG benefits have become increasingly valuable as institutional investors place greater emphasis on sustainability metrics. Solar roof PPAs deliver measurable advantages across all three ESG dimensions.

From an environmental perspective, the impact is substantial and quantifiable. A typical 100,000 square foot industrial property can support approximately 1 MW of solar capacity, generating around 1,300 MWh of clean electricity annually and offsetting roughly 550 metric tons of CO₂ emissions. For large industrial REITs, this can translate to carbon reduction equivalent to removing thousands of cars from the road.

These environmental benefits translate directly into improved sustainability reporting metrics. REITs with comprehensive solar programs consistently achieve higher GRESB (Global Real Estate Sustainability Benchmark) scores, with analysis showing an average improvement of 8-12 points following significant solar roof PPA implementation. This performance enhancement helps attract and retain ESG-focused institutional investors, who now control trillions in deployable capital.

On the social dimension, solar PPAs contribute to community relations and tenant satisfaction. By supporting local clean energy generation and often providing discounted electricity to tenants, REITs strengthen their position as responsible community members and valued landlords. Japanese industrial REIT GLP J-REIT has successfully leveraged this aspect, highlighting how their solar program has improved tenant satisfaction scores by 22% while supporting Japan’s post-Fukushima energy transition.

From a governance perspective, the long-term nature of solar PPAs demonstrates management’s commitment to sustainable business practices and long-term value creation. This forward-looking approach resonates with institutional investors who increasingly view strong ESG governance as an indicator of overall management quality.

Implementation Challenges and Solutions

Despite their compelling benefits, solar roof PPAs present several implementation challenges that REITs must navigate carefully. Understanding these challenges—and the strategies successful REITs have employed to overcome them—is essential for institutional investors evaluating opportunities in this space.

Structural roof considerations represent the most immediate physical constraint. Not all industrial roofs can support solar installations without modification, particularly older properties or those in regions with specific structural requirements for typhoon or seismic resistance. Leading REITs address this by conducting comprehensive structural assessments before negotiating PPAs, sometimes incorporating necessary reinforcements into broader capital improvement plans.

Regulatory complexities also present significant challenges. Power generation and sales regulations vary dramatically across jurisdictions, affecting PPA structures and economics. Singapore’s liberalized electricity market enables direct retail arrangements, while parts of Japan still maintain more restrictive frameworks. Successful REITs develop expertise in local energy regulations or partner with solar developers who possess this specialized knowledge.

Contract structuring requires careful consideration to protect long-term interests. Issues such as roof access, maintenance responsibilities, insurance requirements, and end-of-term arrangements must be carefully negotiated. REITs must balance the desire for simplicity against the need to address contingencies over multi-decade contract periods.

Tenant relations present another consideration. While many tenants welcome access to discounted clean energy, some may have concerns about roof access or potential disruption. Frasers Logistics & Commercial Trust addressed this by developing standardized tenant communication protocols and involvement processes, ensuring transparency throughout implementation.

Finally, the selection of appropriate solar partners is crucial. The long-term nature of PPAs means REITs must carefully evaluate not just pricing but also the financial stability, technical capabilities, and track record of potential solar developers. Several REITs have adopted portfolio approaches, working with multiple solar partners to mitigate counterparty risk.

Future Outlook and Emerging Trends

As solar roof PPAs mature within the industrial REIT sector, several emerging trends are reshaping implementation approaches and expanding potential benefits. These developments will be featured prominently in discussions at the upcoming REITX 2025 summit.

Battery storage integration represents perhaps the most significant emerging opportunity. By incorporating battery systems into solar installations, REITs can capture additional value through demand charge reduction, energy arbitrage, and grid services. Early implementations by ESR Group in South Korea demonstrate how battery-enhanced solar PPAs can increase revenue by 15-30% compared to traditional solar-only arrangements.

Virtual power plant (VPP) participation is gaining traction as electricity markets evolve. By aggregating solar assets across multiple properties, REITs can participate in wholesale electricity markets and demand response programs previously inaccessible to individual solar installations. Australian REIT Centuria Industrial has pioneered this approach, generating additional revenue by allowing their solar assets to be dynamically managed as part of a broader virtual power plant.

Green financing linkages represent another promising development. Several REITs have successfully negotiated financing structures that directly connect solar implementation to preferential borrowing terms. Mapletree Logistics Trust secured a sustainability-linked loan that reduced interest rates based partly on solar deployment targets, effectively creating a virtuous circle where sustainable initiatives directly lower capital costs.

Tenant partnerships are also evolving, with some REITs now developing joint investment models where tenants participate directly in solar economics. This approach aligns incentives more closely and can be particularly effective with tenants who have their own aggressive carbon reduction targets.

Looking ahead, the integration of advanced IoT sensors and digital twins with solar installations will create opportunities for more sophisticated energy management and additional value streams. REITs that develop expertise in this intersection of real estate, renewable energy, and digital technology will likely capture competitive advantages in both operational efficiency and investor appeal.

Conclusion

Solar roof PPAs represent a significant value creation opportunity for industrial REITs, offering an innovative approach to monetizing previously underutilized roof space while advancing sustainability objectives. As demonstrated by industry leaders like Mapletree Industrial Trust, Goodman Group, and Frasers Logistics & Commercial Trust, properly structured solar roof PPAs can deliver meaningful financial returns while simultaneously strengthening ESG credentials and tenant relationships.

For institutional investors evaluating industrial REIT opportunities, solar implementation should increasingly factor into assessment frameworks. The ability to successfully execute solar roof PPAs now serves as an indicator of management sophistication and forward-thinking strategy. REITs that demonstrate expertise in this area often exhibit similar innovation in other aspects of their operations.

As the renewable energy transition accelerates across the Asia Pacific region, industrial REITs with substantial solar roof assets will be well-positioned to benefit from both policy tailwinds and shifting capital allocation preferences. The most successful will be those that view solar not merely as an ESG checkbox, but as a strategic business opportunity that creates multiple avenues for value enhancement.

For REITs considering solar roof PPA implementation, the experiences documented in this case study provide valuable lessons: start with suitable properties, partner with reputable developers, structure agreements to balance predictability with upside potential, and integrate solar initiatives into broader ESG and tenant engagement strategies.

As we look toward the next decade of industrial REIT evolution, solar roof PPAs will likely transition from innovative differentiator to essential component of portfolio optimization—creating sustainable value for investors, tenants, and the broader community alike.

Join the Conversation at REITX 2025

To learn more about innovative approaches to value creation in REITs, including solar roof PPAs and other sustainable investment strategies, join us at REITX 2025, Asia Pacific’s premier institutional real estate investment summit.

Hear directly from the executives and investment leaders implementing these strategies and network with institutional investors at the forefront of sustainable real estate investment.